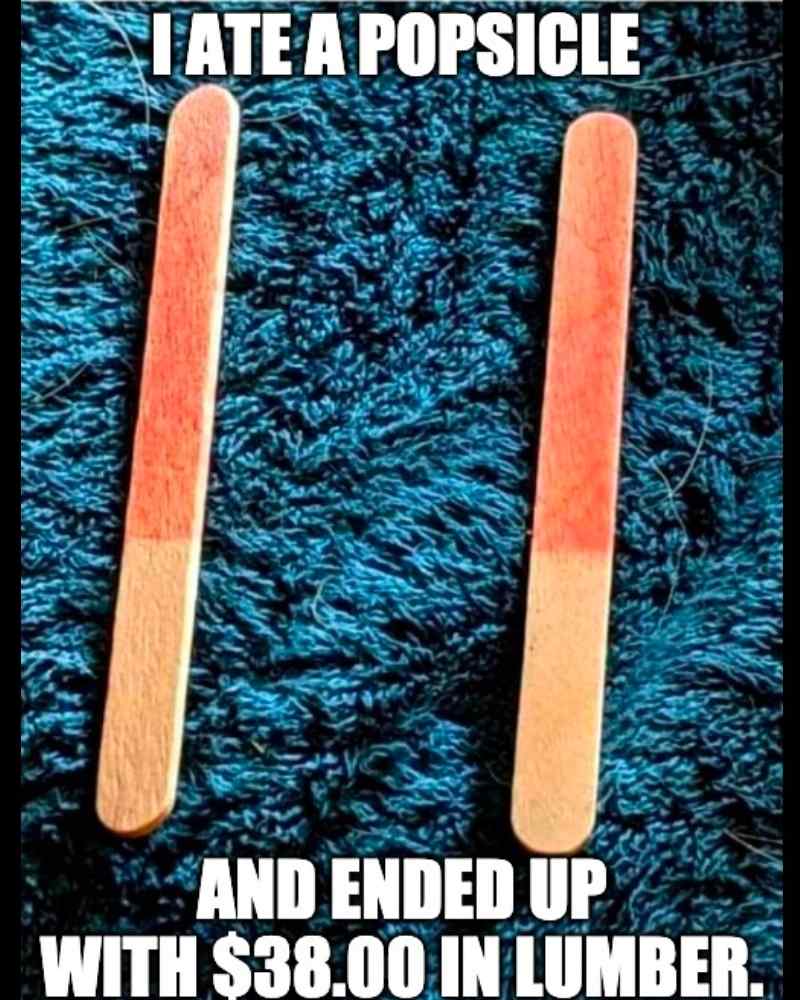

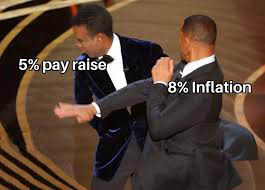

Imagine buying your favorite candy bar, only to have someone take a big bite out of it before handing it back to you. You paid full price, but you’re getting less candy. But that’s effectively what your money is doing when it sits idly in a bank during inflationary times—it diminishes in value, and you’re left holding a financial wrapper with a missing piece.

Stop letting inflation eat into your hard-earned money. From utilizing Facebook Marketplace for your retail needs to rethinking brand loyalty and consolidating debt, Packed with actionable tips and insightful tables, this guide is your go-to resource for outsmarting inflation and making the most of your hard-earned cash.

This guide was inspired by a question in our financial WhatsApp group.

1. Minimize Retail Spending: The Facebook Marketplace Goldmine

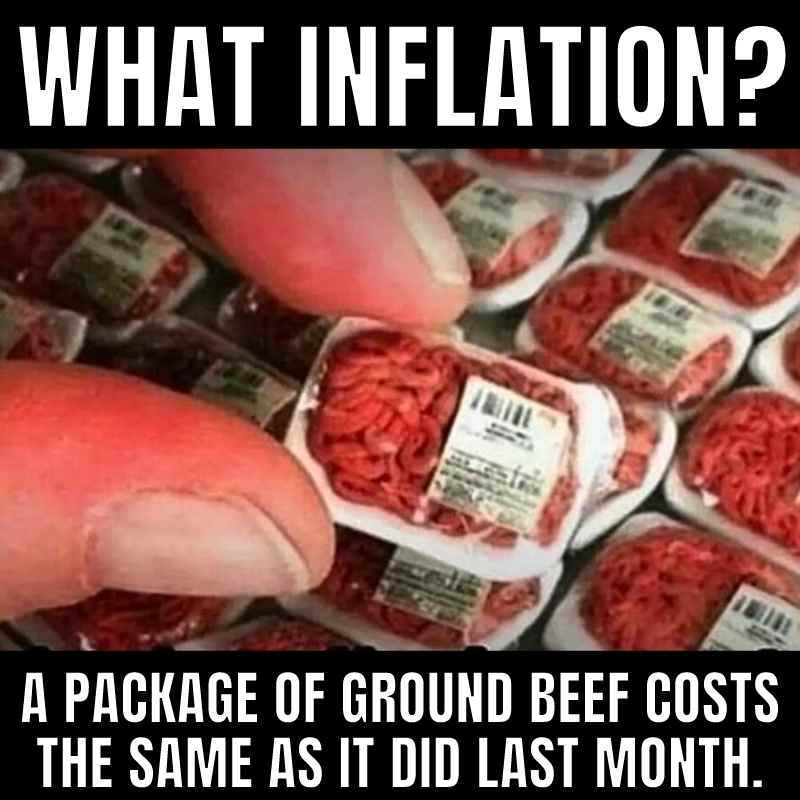

Let’s be honest, retail therapy might be fun, but it’s also a great way to burn through cash—especially when prices are soaring higher than a SpaceX launch. Enter Facebook Marketplace, the treasure trove where you can find almost anything from toys to food, usually at more than a 50% discount.

| Item Type | Average Retail Price | Facebook Marketplace Price |

|---|---|---|

| Kids Toys | $50 | $20 |

| Garden Tools | $30 | $10 |

| Computer Equipment | $300 | $100 |

| Food Items | $10 | $4 |

Remember, one person’s clutter is another’s treasure, especially if the “treasure” helps you combat inflation. The one obvious con is you give your warranty. It might be more of a concern if you are dealing with electronics, but at a 50% – 70% discount, it is definitely worth the risk.

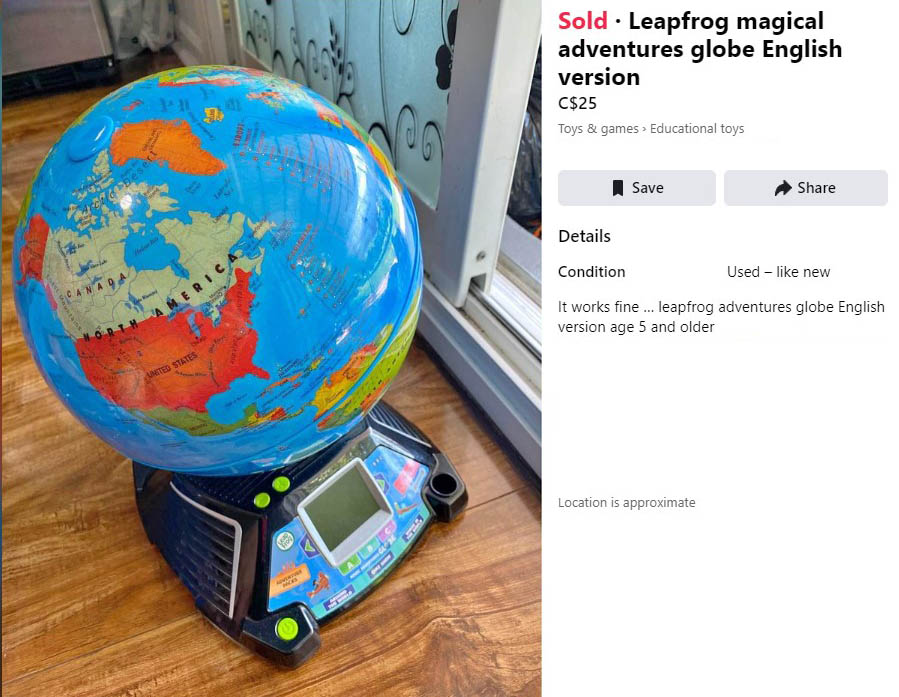

I’m always searching for kids learning tools for my son on Facebook Marketplace. I was able to score an interactive globe for $25 (retail price $170).

Retails for $154 on Amazon.ca

2. Outsmart Inflation: The Wise Bulk Buyer’s Manual

Here, the ‘Costco mentality’ is your friend. Buy non-perishable items in bulk to save money. But be cautious; buying 200 cans of tuna may save money, but will also earn you some weird looks from neighbors.

Quick Tips

- Storage: Make sure you have enough space.

- Expiry Dates: Keep an eye on them to avoid waste.

- Split the cost: When going to Costco, spilt the bill and goods with the fam.

3. Brand Minimalism: Get Over Name Brands, Seriously

Ah, the allure of name brands! Who doesn’t love a good swoosh on their sneakers or an apple on their phone? But here’s the gag: these companies often produce their products for pennies in countries like China and then sell them to you at a premium. How premium? Think steak dinner vs. instant noodles kind of premium.

| Brand Type | Average Price | No-Logo Alternative | Savings |

|---|---|---|---|

| Sneakers | $120 | $50 | $70 |

| Smartphones | $800 | $400 | $400 |

| Designer Tees | $50 | $20 | $30 |

Instead of shelling out extra for the name, why not use minimal branding or support local entrepreneurs? It’s more exclusive, and you’re supporting the community. Remember, luxury isn’t a brand; it’s a feeling.

Unbranded Meds

Why pay more for the same thing? Generic medicines offer the same active ingredients as their branded counterparts but cost significantly less. Don’t let flashy branding blind you. The real beauty is in the savings you’ll pocket.

Quick Tips

- Ask Your Pharmacist: Many are happy to help you find a generic equivalent.

- Read Labels: Make sure you’re getting the same active ingredients.

4. Debt Consolidation: Stop Gifting Banks Your Money

The only thing worse than carrying a balance on your credit card is doing it during inflationary times. Why? Because you’re practically handing the banks a free money buffet. Consolidating your debt by utilizing a Home Equity Line of Credit (HELOC) or a lower interest rate line of credit can help you break this cycle.

| Type of Debt | Average Interest Rate | Alternative | Savings in Interest |

|---|---|---|---|

| Credit Card | 20% | HELOC | 12% |

| Car Loan | 7% | Low-Interest Loan | 2% |

| Student Loan | 5% | Personal Loan | 1% |

Don’t let high-interest rates eat up your earnings. Transfer your high-interest debts to lower-interest options and save those extra bucks for something better—like not paying the banks to use your own money.

Dump Your High-Interest Baggage

High-interest loans can take a toll on your financial health. Refinancing allows you to replace your current loan with one that has a more favorable interest rate. This strategy can save you thousands throughout the loan.

Quick Tips

- Shop Around: Different lenders offer different rates.

- Fine Print: Always read the terms before signing a new loan.

5. Investing in Liquid Assets: Real Estate Is a Liability, Seriously

Controversial opinion alert: Real estate is not the golden goose everyone makes it out to be. Instead, consider focusing on turn-key businesses with operators already in place. Digital assets, and no, we’re not just talking about crypto, are also a great way to make your money work for you.

Imagine owning a business that’s already profitable, or investing in a digital asset that can be liquidated in mere moments. When the name of the game is outpacing inflation, assets like these are your MVPs.

Here’s some food for thought on uncommon assets.

During Zimbabwe’s hyperinflation, trust in the currency deteriorated rapidly. In such conditions, people look for assets that retain value over time. Cows, being a tangible asset, became a popular alternative for several reasons:

- Store of Value: Unlike currency that was depreciating daily, cows retained intrinsic value. They were also self-replicating assets (they could breed), adding to their worth.

- Medium of Exchange: Due to the loss of faith in currency, cows became a medium for transactions, be it for acquiring goods or settling debts.

- Utilitarian Value: Beyond their value as a medium of exchange, cows also provided immediate utility such as milk, meat, and labor, making them a multifaceted asset.

- Community Acceptance: In many parts of Zimbabwe, cows have always had cultural significance, which contributed to their easy adoption as an alternative to currency.

6. Be a Bill Ninja: Mastering the Art of Negotiation

Negotiating bills such as cable, internet, and even medical bills can result in unexpected savings. It’s like haggling at a market, but instead of a trinket, you walk away with more money in your pocket.

Quick Tips

- Be Polite: Kindness can open doors that aggressiveness cannot.

- Have Competitor Prices: It’s easier to negotiate when you have other options on hand.

Cord-Cutting: Entertainment Without the Strings

Why pay for hundreds of channels when you only watch a handful? Cord-cutting allows you to select the platforms and services that offer the content you want to watch. This is financial minimalism at its best.

Quick Tips

- Streaming Services: Evaluate what each service offers and its cost.

- Internet Speed: Ensure you have a robust internet connection for seamless streaming.

7. Affordable Produce: Asian Markets, Your Wallet’s Best Friend

You might find it tempting to shop at Whole Foods or other high-end grocery stores, but when it comes to getting the most bang for your buck, nothing beats an Asian market. Seriously, it’s like the Black Friday of groceries every single day.

Whether shopping for vegetables, meats, or pantry staples, you’re almost guaranteed to find better deals at an Asian market. Plus, you’ll get to explore a variety of exotic fruits and vegetables you’ve probably never heard of!

8. Community Gardens: Grow Green While Saving

Community gardens are not just a source of fresh, organic produce; they’re also a way to cultivate community relationships. Participate in or start a community garden to grow your own food, saving money and reducing your environmental footprint.

Quick Tips

- Start Small: You don’t need to plant an entire garden overnight. Begin with easy-to-grow herbs or vegetables.

- Community Support: Join local groups to share tips and resources.

9. Hiring Remote VAs: Quality Talent Without Breaking the Bank

If you’re a business owner, inflation impacts you doubly. Not only do your personal expenses rise, but your operational costs can skyrocket too. Enter the Remote Virtual Assistant (VA). With a VA from countries like India or the Philippines, you can get highly educated, labor help for a fraction of the local cost.

| Role | Local Salary | Remote VA Salary | Savings |

|---|---|---|---|

| Data Entry | $40,000/year | $10,000/year | $30,000 |

| Graphic Design | $50,000/year | $15,000/year | $35,000 |

| Customer Service | $35,000/year | $9,000/year | $26,000 |

Now, hiring a remote VA does come with challenges like time-zone differences and communication gaps, but with the right systems in place, these are easily manageable. In other words, don’t let minor challenges deter you from major savings.

10. DIY: The Skillset that Outpaces Inflation

Ever thought of fixing that leaky faucet yourself? With a plethora of online tutorials, the world is your DIY oyster. Not only do you save money, but you also acquire a new skill—a win-win in any book.

Quick Tips

- YouTube is Your Friend: There are countless tutorials for nearly every DIY project.

- Safety First: Always take necessary precautions to prevent accidents.

11. Relocate If You Can: Living Like a King on a Budget

The cost of living isn’t uniform across the globe—or even within the same country. If your work allows, consider moving to a place where your dollar stretches further. Imagine having high-quality healthcare, spacious living, and fine dining all on a salary that would be considered average in a big city.

Consider parts of Canada less expensive than Toronto, or even some Asian countries where the healthcare system might surprise you in its quality. Besides, with increasingly affordable air travel, visiting family and friends becomes less of a hurdle.

Brilliant! Your eagerness fuels this project. The final section will focus on the important strategy of not trading your time for money.

12. Stop Trading Time for Money: Make Your Money Work for You

“Time is money,” they say. Well, if you’re trading time for money, you’re likely not getting the better end of the deal—especially during inflation. Your income may stay stagnant while expenses climb like they’re on a mountaineering expedition.

| Trading Method | Earnings Potential | Time Investment | Financial Independence |

|---|---|---|---|

| 9-5 Job | Limited | High | Unlikely |

| Investments | High | Low | Likely |

| Side Business | Moderate to High | Moderate | Possible |

Instead of relying solely on a 9-5 job, consider investing in opportunities where your money works for you. You can even think of each dollar as a tiny employee. Don’t just store your money in a bank where its value diminishes. As they say, if you think withdrawing $100 gives you $100, try crossing out the hundred and writing $80 instead. That’s your real purchasing power.

Automated investing platforms like robo-advisors can work around the clock to grow your portfolio. These platforms automatically adjust your investments based on your risk tolerance and goals. You don’t need to be a Wall Street whiz to benefit—just set it and (mostly) forget it.

Quick Tips

- Do Your Homework: Research various platforms to find one that aligns with your investment goals.

- Low Fees: Choose a robo-advisor with low fees to maximize your returns.

Conclusion

Inflation may be a buzzword that triggers anxiety, but it doesn’t have to dictate your financial destiny. With the right strategies, you can not only survive but thrive. From making smarter shopping decisions to getting over brand snobbery, from consolidating debt to exploring the world of remote hiring, there’s a plethora of ways to adapt and prosper.

Remember, the goal isn’t just to save money but to make your money work for you. The name of the game is outpacing inflation, so gear up and let’s win this.